The Essential Report Archive Read the latest report

-

The Economic Forest, Not The Short-Term Accountant’s Trees

Can we suggest a slight re-framing of the debate around the National Disability Insurance Scheme, a re-framing that will, we think, force Barry O’Farrell, Ted Baillieu and Campbell Newman — the state premiers who are opposing putting up a tiny amount of money — to come up with a new rationale.

In a business, the kind of thing the aforementioned state premiers usually embrace as the foundation of all that is good, there are two sides of a ledger: expenses and income. You have to take into account BOTH SIDES.

In the debate over NDIS, all we hear from the opponents — all members of the Coalition — is how much the program will cost. Putting aside the moral argument that there is an obligation to provide support for all of our citizens, may we point out a fact: investing in NDIS will make money. Full stop.

Let’s repeat that: money going into the program will INCREASE the wealth of the country.

This isn’t a political argument. It’s an economic fact.

And it comes not from some left-wing think tank but from the Australian Government’s Productivity Commission July 2011 report:

The most important of the economic benefits are the welfare impacts for people with a disability and their carers. While not counted in official statistics about the performance of the economy, these are genuine and large economic gains. One, partial way of assessing these gains is the value of the implicit income transferred by the NDIS to people with disabilities. Commission estimates suggest benefits of around $7.8 billion annually (and this already takes account of the lost consumption for those people funding the scheme). This is likely to significantly understate the benefits.

It is harder to measure some of the other economic benefits of the NDIS, but it is possible to assess some of its economic effects. These will take some time to emerge. Were Australia to achieve employment ratios for people with disabilities equivalent to the average OECD benchmark — a highly achievable target given the proposed reforms — employment of people with mild to profound disabilities would rise by 100 000 by 2050.

In fact, the package of measures, including through reforms to the Disability Support Pension (DSP), would be likely to raise employment by considerably more than 100 000. Under a reasonable scenario, the Commission estimates that there could be additional employment growth of 220,000 by 2050 (including for people with less severe disabilities).

By 2050, the collective impact of these two employment gains would be around a one per cent increase in GDP above its counterfactual level, translating to around $32 billion in additional GDP (in constant price terms) in that year alone.

Bottom line: from an economic health point of view, it would be foolish not to invest in the NDIS.

People are definitely entitled to their opinions. But, they aren’t entitled to their own facts.

-

A Nation’s Greatness

Mahatma Ghandi said, “A nation’s greatness is measured by how it treats its weakest members.” A thought that is pretty darn relevant when thinking about the debate over the National Disability Insurance Scheme.

We know tens of thousands of Australians agree with Ghandi’s sentiments, since, as of this writing, almost 126,000 people have signed on to support the Every Australian Counts campaign.

We know the Prime Minister supports NDIS. So, do a few state premiers. Here’s how it shapes up:

Only the small Labor jurisdictions of the ACT, South Australia and Tasmania secured trials after offering funds. Every Coalition-led state refused.

Just so we’re clear about the economics, per Anne Manne in The Monthly:The economics of disability are bleak. Nearly one-third of households involving a person with a disability live close to or below the poverty line, compared to one-tenth of Australians overall. As Bill Shorten pointed out in a speech made after the release of the 2009 report Shut Out: The Experience of People with Disabilities and their Families in Australia, a person with a disability is more likely to be unemployed and on income support, and to live in public housing or be renting. They are less likely to complete secondary education. Worrying numbers of people with an intellectual disability end up in jail. Children with additional needs require early intervention but don’t often get it. As their parents know, for each year such crucial help is missing, behavioural problems and educational deficits multiply.

And per Barrie Cassidy today:

On the face of it, the failure of the richest states to cough up a relative pittance towards the trials appears to be the dumbest – and meanest – act by leading politicians in a very long time.

Perhaps there is a plausible explanation to the intransigence of Barry O’Farrell, Ted Baillieu and Campbell Newman; perhaps it does go beyond the suspicion that they are merely playing a political game, denying the Prime Minister a “win” no matter what the issue.

But, there is another way of viewing this through the lens of the sports event captivating the planet at this moment: The Olympics. Countries put a lot of energy into making sure athletes bring home the gold. A victory fills the country with national pride.

And no country, including Australia, wins medals without investing a lot of public money into the preparation of their athletes. Tax money.

Consider this, from a PriceWaterhouseCoopers report, when thinking about Australia versus the host of the Olympics, the United Kingdom

An international comparison of disability-related expenditure (to the extent that this is possible) indicates that, compared with other countries, Australia has a lower level of spending as a share of GDP on longterm care for people under the age of 65. Expenditure is more than double in the Scandinavian countries of Denmark, Sweden and Norway, and slightly less than double in the United Kingdom when compared with Australia. [emphasis added]

No one knows today whether Australia will bring home the gold from London. But, wouldn’t it be nice if, no matter how the games turn out, we felt great pride because we led the world in investing money in something that isn’t a game: peoples real, daily lives.

— Jonathan Tasini

@jonathantasini -

Australian Workers Union, Paul Howes

Howes On Industry Planning

Paul Howes speaks today on industrial strategy at the Queensland Media Club at 1.20pm. Here is an excerpt of the speech to be given obtained exclusively by the Broadside Blog.

Tonight, of course, is the opening ceremony of the London Olympics.

I’m sure that many of us will be having some late nights over the next three weeks watching our Aussie athletes go for gold.

After the Tour de France, it’s probably the last thing our sleep-deprived nation needs.

But while your enjoying the Games, and barracking for Mitchell Watt and Sally Pearson, think about this:

Australia’s Olympic Games campaign is actually a classic example of how Australia can do industry planning really well.

We set national objectives – like finishing in the top five of the medal count.

We pick winners – focusing on areas where we have a competitive strength, like swimming.

We invest in R & D – engaging the best sports scientists, and supporting our elite athletes through the Australian Institute of Sport.

We even build an elite training centre in Northern Italy, with all be best high-tech equipment – so our athletes can have a European base during the Australian winter

We don’t question the need for public investment in our Olympic effort – we accept that it’s necessary for success.

In sport, Australians play to win, and we don’t apologise for being successful.

Yet when it comes to our income and job-generating industries, we expect them to stand or fall on their own two feet.

Well, the AWU doesn’t want to see Australian industry lose.

We want Australian industry to be winning gold medals, not just digging them up.

-

Australian Workers Union, caltex, Paul Howes

Sneaky, Sneaky: The Caltex Way of Treating Workers

To the long list of sneaky and dishonorable ways of doing business in the corporate world, we can now add Caltex. You may remember that the Australian Workers Union was trying to engage the Woolworth’s-Caltex partnership in a dialogue about the future of the Kurnell refinery in Sydney. And, then, boom, the axe comes down and, poof, 630 people will lose their jobs in a bolt from the blue announcement this morning.

Per the Sydney Morning Herald today:

Petroleum company Caltex will close its Kurnell refinery in Sydney in a move that will cost up to 630 jobs, with unions claiming the announcement is a “kick in the guts” to Australian motorists.

Caltex said the refinery would be closed in the second half of 2014 and would be converted to a “major import terminal” to supply imported fuel for Australian customers. The closure would eliminate about 330 direct positions, and as many as 300 contracting jobs.

It isn’t just the refinery that smells here. It’s the whole disregard for the community, per the AWU:“It’s the first we heard of the announcement,” the spokesman said.

“We knew [shutting the refinery] was an option and that the company was holding a review, but until today we were hopeful.”

The spokesman said the AWU would be pressing Caltex for answers, and would hold a noon press conference at the Kurnell refinery. He believed the consultation had been “very limited” and said the figure of about 800 jobs at risk was accurate. [emphasis added]

Skilled trades workers — 300 permanent workers and many more casuals and contractors — will be hit as well, as we learn from Tim Ayers, state secretary of the Australian Manufacturing Workers Union, who sent the Broadside Blog these comments:“These are highly skilled workers. Today’s announcement is a blow to them. It will also have knock-on effects for industry supply chains across NSW and undermine prospects for the next generation of skilled blue collar workers in NSW.

During the O’Farrell Government’s short term in office, Sydney has lost both its major refineries, hitting jobs and leaving the state dependent on imported refined oil products.

Barry O’Farrell has not lifted a finger to ensure jobs and production capacity were maintained at Sydney’s Kurnell and Clyde refineries,

This government appears to have no plan for supporting local jobs and industry.

The company basically decided this, on its own, workers and communities be damned.We’ll keep people updated on the developments, especially from today’s presser. -

Carbon Tax, climate change, Greenland

I’m Melting, I’m Melting

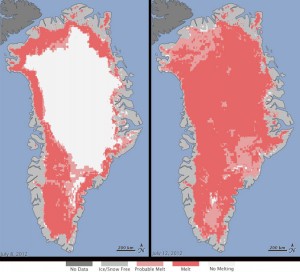

Lost, sometimes, in the debate over the carbon tax — which usually focuses on how much the tax will cost us (The Empty Suit, leader of the Coalition, is in deep trouble here, by the way, because it turns out the cost to the average person will be pretty modest, despite his fear-mongering) — is what happens if we don’t reduce carbon emissions. Here’s a picture that tells it all.

On your left is the Greenland ice sheet on July 8th. On your right is the Greenland ice sheet on July 12th — four days later.

Translation: In just a few days, the melting had dramatically accelerated and an estimated 97 percent of the ice sheet surface had thawed by July 12.

Need we say more? Tony Maher, Construction Forestry Mining and Energy Union national president, had it right, by the way.

-

Austerity, europe, European Central Bank, European Commission, IMF, ITUC, Sharan Burrow

We Can’t Eat Austerity

We are in a world where people are being taken out and economically shot, executed by the terror of the balance sheet. Turn to Europe and you’ll see the plan: a troika — the International Monetary Fund, European Central Bank and European Commission — keep thinking that the path to a stable world is by making their balance sheets work, no matter how many people must suffer.

Sharan Burrow, the General Secretary of the International Trade Union Confederation (ITUC), has it exactly right, when she led a delegation to meet with the Greek labour minister and called out the Troika for pursuing mindless austerity:

The Troika needs to start by looking at the incomes of working people and unemployed. If you have more than 20% of the workforce unemployed and 50% young people excluded from secure jobs and livelihoods, and a minimum wage that has been cut by up to 32%, people will not be able to survive.

It takes a union leader to understand what is up and what is down, what is reality for people:

There is a lack of sanity of the part of these institutions. You can’t keep putting money into the bond markets and the banks, but have countries where people can’t eat, feed their children or pay their bills. This is an economic model that is not creating jobs, protecting livelihoods or providing the social protection that people need to stabalise the economy.

Burrow’s final point sums up the world we live in:

People are being discarded, as the interests of banks and bond markets come before families.

Now, we could say, and we would be right, that these policies are insane, immoral and economically dubious. Except that the Troika, and the institutions representing the bond holders and banks don’t operate in a moral world — meaning, a world where economic policy is built around bringing prosperity to the people. If that were the case, bankers would be in jail, the richest among us would pay far higher taxes and, rather than impose austerity on people who had no hand in creating the current crisis, we’d be spending trillions of dollars to make sure people had jobs — and a way to put food on the table.

Pause on that final point. We aren’t talking about fur coats and mansions. As Burrow says, this is about people being able to eat.

-

Spanish Swoon Taking Germany Down

It’s one thing for the bond market vigilantes to try to skin the people of Spain. But, uh oh, Germany is another issue — and you should care about this little new twist because it will reverberate around the world.

I’m not a fan of Moody’s, largely because it sat around rating as AAA all those bad mortgages that ended up creating the Global Financial Crisis. But, the ratings agency still has sway so, shudder hard at this report:

The ratings firm Moody’s Investors Service late Monday dimmed its outlook on Germany, the euro zone’s dominant economic power and political force, further exposing the currency bloc’s fragility on a day that also saw markets drop around the world on fears about Europe.

Moody’s cited the huge potential cost of a euro breakup and, alternatively, the steep bill that would be paid to hold it together.

The warning to Germany followed a dramatic flight by investors from Spanish bonds Monday, leaving the euro zone’s fourth-largest economy at grave risk of needing a bailout and sparking a selloff on global markets.

Remember the recent story. China is slowing. The mining boom will not last forever. If you add to that Germany — Germany!!! — at risk…cover your eyes from the unfolding disaster.

-

Early Childhood Australia, funding, Samantha Page

Family Values Isn’t Free

Family values. It’s something everyone wants to embrace. But, beyond making broad statements, the bottom line is…well, the bottom line. If you love families, you probably love children…but what happens when it gets to supporting early childhood education and care reforms?

We noticed this concern raised this past Friday by Early Childhood Australia:

Peak children’s body Early Childhood Australia (ECA) have expressed concern today about statements from Shadow Minister for Childcare and Early Childhood Learning, Sussan Ley that suggest the opposition is considering winding back early childhood education and care reforms.

ECA today urged Shadow Minister Ley to consult more broadly on the reforms and hear from children’s advocates, experts and the many service operators already successfully implementing the reforms, about the long-term benefits of quality early education and care.

“We need to see bipartisan support for improving the quality of early childhood education and care for the sake of the 1.5 million Australian children in these services,” said ECA chief executive Samantha Page.

Seems like it should be a no-brainer for early childhood education to be a bi-partisan effort, enjoying broad support no matter who’s running the show.