The Essential Report Archive Read the latest report

-

02 October 2012, 021012, Carbon Tax, goods and services, price increase

Reasons for prices increases under the carbon tax

Q. In respect of the increases to the costs of goods and services that you have noticed, do you believe that they are due to the carbon tax?

n=717

Total

Vote Labor

Vote Lib/Nat

Vote Greens

Yes 62%

45%

73%

46%

No 12%

22%

8%

9%

Not sure 26%

33%

19%

45%

The 69% of respondents (n=717) that believed they had noticed a price increase were asked whether they believed the increases were due to the carbon tax.

Sixty two per cent (62%) of these respondents believe that it is due to the carbon tax, whilst 12% do not. Twenty six per cent (26%) of respondents were not sure.

Looking at the results by voting intention, Coalition voters were the most likely to attribute price increases to the carbon tax (73%) and 8% did not.

Forty five per cent (45%) of Labor voters believe the increases are due to the carbon tax and 22% do not.

Whilst 46% of Greens voters believe that the increases are due to the carbon tax (46%) an almost equal portion (45%) remain unsure.

-

10 September 2012, 100912, age pension, ALP, Carbon Tax, decisions, GFC, Gonski, low incomes, marine reserves, NBN, ndis, tax free threshold

Decisions of the Labor Government

Q. Thinking about the decisions the Labor Government has made over the last few years, do you think the following decisions were good or bad for Australia?

Total good

Total bad

Very good

Good

Neither good nor bad

Bad

Very bad

Don’t know

Expanding dental health services for people on low incomes 77%

5%

33%

44%

14%

2%

3%

5%

Increasing the tax free threshold from $6,000 to $18,200 75%

4%

36%

39%

16%

3%

1%

5%

Increasing the age pension 70%

11%

30%

40%

13%

7%

4%

6%

Increasing superannuation from 9% to 12% 68%

9%

27%

41%

16%

6%

3%

6%

Protecting large areas of Australia’s marine environment in a network of marine reserves 67%

8%

28%

39%

20%

5%

3%

7%

Introducing the National Disability Insurance Scheme 58%

5%

21%

37%

23%

3%

2%

14%

Implementing the recommendations of the Gonski report to increase education funding 54%

8%

20%

34%

25%

5%

3%

13%

Stimulus spending to tackle the Global Financial Crisis (GFC) 54%

22%

22%

32%

18%

14%

8%

8%

Spending on new school buildings during the GFC 53%

22%

15%

38%

18%

12%

10%

6%

Paid parental leave 52%

20%

17%

35%

23%

12%

8%

5%

Introducing a tax on large profits of mining companies 49%

25%

24%

25%

17%

13%

12%

8%

Implementing the recommendations of the expert committee on asylum seekers including offshore processing 45%

15%

15%

30%

28%

8%

7%

12%

Building the NBN (National Broadband Network) 43%

28%

17%

26%

22%

14%

14%

7%

Abolished WorkChoices 42%

27%

23%

19%

19%

17%

10%

12%

Introducing a carbon tax to tackle climate change 28%

51%

14%

14%

15%

16%

35%

7%

The two most popular decisions of the Labor Government are ‘expanding dental health services for people on low incomes’ (77% total good) and ‘increasing the tax free threshold from $6,000 to $18,000 (75% total good). The least popular decisions were ‘Building the NBN’ (43% total good), ‘Abolished WorkChoices’ (42% total good) and ‘introducing a carbon tax to tackle climate change’ (28% total good).

Of the fifteen decisions put to respondents, the majority of respondents believed that 10 of the 15 decisions were good for Australia. For the remaining 5 decisions, a larger portion of respondents generally regarded the decision to be good for Australia except for ‘introducing a carbon tax to tackle climate change’, where the majority of respondents (51%) believed it to be bad for Australia.

Female respondents were more likely to endorse the dental health reforms (80% total good) compared with male respondents (74% total good).

Increasing the age pension was most strongly supported by respondents aged 65+ (77% total good).

Introducing paid parental leave was more popular with female respondents (57% total good), compared with male respondents (46% total good). Looking at this decision by age, it was most popular amongst respondents aged 25-34 (62%) and 35-44 (62%) whereas respondents aged 65+ were the most likely to regard the decision as a bad one (36% total bad).

Implementing the recommendations of the expert committee on asylum seekers including offshore processing proved to be a very popular decision amongst respondents aged 65+ (65% total good), whereas respondents aged 25-34 were the most likely to regard it as a bad decision (43% total bad).

Female respondents were more likely to regard ‘protecting large areas of Australia’s marine environment’ as a good decision (72% total good) compared with male respondents (60% total good).

-

20 August 2012, 200812, Carbon Tax, cost of living, goods or services, increase

Price Increases Since Carbon Tax

Q. Since the carbon tax was introduced on 1st July, have you noticed any increase in the costs of goods or services?

Total

9 July

Total

20 Aug

Vote Labor

Vote Lib/Nat

Vote Greens

Yes, have noticed an increase in costs 31%

52%

34%

68%

29%

No, have not noticed any increase in costs 54%

36%

54%

21%

64%

Don’t know 15%

12%

12%

11%

7%

52% say they have noticed an increase in the costs of goods or services since the carbon tax was introduced – up 21% from 31% recorded the week after the carbon tax was introduced – and 36% say they have not noticed any increase in costs.

Those most likely to say they have noticed an increase in costs were aged 35-54 (56%) and Liberal/National voters (68%).

-

20 August 2012, 200812, Carbon Tax, price increase

Main Reason for Price Increases

Q. Do you believe these price increases are due mainly to the carbon tax, or mainly due to other reasons? *

Total

Vote Labor

Vote Lib/Nat

Vote Greens

Mainly due to carbon tax 72%

53%

81%

70%

Mainly due to other reasons 17%

36%

9%

18%

Don’t know 11%

12%

10%

13%

* based on the 52% who have noticed price increases

72% of those who said they had noticed cost increases think it is mainly dues to the carbon tax.

Those most likely to blame the carbon tax were Liberal/National voters (81%), aged under 35 (78%) and those earning over $1,000pw (76%).

-

carbon pricing system, Carbon Tax, electricity costs, Julia Gillard, tony abbott

Fuzzy Facts From The Empty Suit

The PM is going to be chatting live on-line today at News.com, focused on the question of rising power prices. This should be a pretty straightforward issue, with facts guiding the discussion. But, The Empty Suit, Leader of the Coalition, is trying to muddle the issue…and who can blame him? He’s rolled the dice trying to scare the entire nation about the carbon tax — which is proving to be a non-event.

Yes, prices of electricity are going up. But, it’s pretty clear this has virtually nothing to do with the carbon tax.

Here is a pretty simple explanation from the PM, as a curtain-raiser to her on-line talk:

First, the states who own electricity network businesses are doing well out of it.

Take New South Wales: separate to carbon pricing, there’s been a 70 per cent increase in prices over four years. And there’s been a 60 per cent increase in the dividends that the NSW Government gets.

Second, meeting peak power costs too much. One quarter of your electricity bill, more than $500 a year for a typical family, is spent to meet the costs of peak events that last for less than two days each year in total. It’s like building a ten-lane freeway, but with two lanes that are only used or needed for one long weekend.

Third, customers need more choice. The states should sign up to the National Energy Customer Framework, with strong protections when people can’t pay their electricity bills and extra information to help customers get the best energy deal.

And finally, I am pushing for the whole electricity system to operate more efficiently and more effectively. I’d rather do this with the states. We’ll only use the big stick of stronger powers for the Energy Regulator and the ACCC if we have to.

In other words, it’s the electricity generating companies who are trying to sock us with costs for building up new capacity. In Queensland and Victoria, the power companies have not invested in new capacity since 1998 — and, as the PM points out, they now need to do so largely to absorb peak power needs for just a few days a year. That has zero to do with the carbon tax. None. Nada.

The Empty Suit, though, is in a real box. He has staked a huge part of his campaign on the “sky is falling” results from the carbon tax. So, when you listen to what he says now, pay very little attention because it’s not based on the real facts on the reason for the rise in electricity prices.

-

Carbon Tax, climate change, Greenland

I’m Melting, I’m Melting

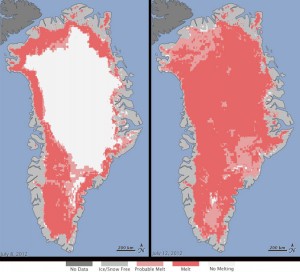

Lost, sometimes, in the debate over the carbon tax — which usually focuses on how much the tax will cost us (The Empty Suit, leader of the Coalition, is in deep trouble here, by the way, because it turns out the cost to the average person will be pretty modest, despite his fear-mongering) — is what happens if we don’t reduce carbon emissions. Here’s a picture that tells it all.

On your left is the Greenland ice sheet on July 8th. On your right is the Greenland ice sheet on July 12th — four days later.

Translation: In just a few days, the melting had dramatically accelerated and an estimated 97 percent of the ice sheet surface had thawed by July 12.

Need we say more? Tony Maher, Construction Forestry Mining and Energy Union national president, had it right, by the way.

-

Carbon Tax, Greens, Tony Maher

Feral cats amongst the carbon canaries

Tony Maher over at the Construction Forestry Mining and Energy Union has a piece in the Daily Telegraph worth reading.

Feral cats amongst the carbon canaries

TONY MAHER Tony Maher is Construction Forestry Mining and Energy Union national president.

It’s a truism that Labor has done a dismal job selling its carbon pricing scheme. But that doesn’t tell the full story of how the 2012 carbon tax became so politically toxic. A key ingredient is the widely held perception that it is a Greens scheme developed under duress, with Labor held hostage to its Birkenstock-wearing overlords.

Most Australians in the suburbs and regions think if the Greens support something it must be bad for jobs, cost too much and be no fun at all.

Actually, the carbon pricing scheme of 2012 is substantially the same as the carbon pollution reduction scheme proposed by Labor, supported by the Liberal Party under Malcolm Turnbull and blocked by the Greens in 2009. If anything, the 2012 version is browner than its predecessor.

As the weeks roll on after Doomsday (July 1), the carbon price scheme is proving well designed and is working exactly as intended. It is not causing job losses because it was carefully designed not to cause job losses.

Billions of dollars have been allocated as free permits to heavy industry, precisely because the objective is to help keep them in business while investors adjust. No sector has been overlooked.

Likewise, the carbon pricing scheme has not fed into excessive price rises. The tiny price rises are exactly those predicted by the government.

This is not good luck. It is a result of careful design to cushion consumers and businesses. Labor listened to businesses, welfare groups and unions — designing tax cuts and welfare payments accordingly, while excluding petrol from any impost.

It’s no surprise that Tony Abbott can’t find a price increase horror story.

A question raised by many is — if business and consumers are both wrapped in cotton wool, what’s the point?

The point is it is a signal to investors making decisions today on assets that will last 20 to 50 years. It is not designed to force consumers to use significantly less energy — there will be other energy efficiency programs for that.

It is not designed to close heavy industry. It gives heavy industry — our mines, smelters and factories — an incentive to improve performance over time. It will drive investment in more efficient and lower emission products and processes.

The carbon tax is structural economic change — a change in the market which is gradual and smooth — by design.

The scheme proposed by Kevin Rudd in 2009 was substantially the same.

Both schemes were an emissions trading schemes with a fixed price at the start — oneyear fixed price in 2009 and three-years fixed price in 2012. Both schemes provided industry assistance through free permits.

In fact, the 2012 version includes more assistance to heavy industry. The 2009 scheme allocated $7.3 billion to power generators over 10 years. The 2012 scheme allocates $5.5 billion over five years.

The 2012 scheme includes an extra $300 million for the steel industry. It also gives more to coal — up from $750 million to assist with capturing fugitive methane emissions in 2009 compared to $1.3 billion in 2012.

Both schemes have the same targets — a 5 per cent reduction being the default. Targets supported by Labor and the Coalition but strongly opposed by the Greens are locked in by the 2012 scheme.

The 2009 scheme only excluded petrol for three years. The package the Greens voted for excludes petrol indefinitely.

The Greens point out that the Clean Energy Finance Corporation is an important new development. It is. It is a great new industry policy supporting manufacturing and that’s why unions and industry lobbied for it. This wasn’t the reason the Greens gave when rejecting the CPRS in 2009.

In 2009 there was bipartisan support for an emissions trading scheme. Tony Abbott wasn’t the leader as the Coalition contributed to the scheme’s design. It was the Greens who stopped it in the Senate, wanting higher targets and less compensation to heavy industry.

In 2012 they supported a virtually identical scheme, with the same targets and more assistance to heavy industry.

The Greens intransigence in 2009 has had profound knockon effects. The 2012 scheme, fundamentally the same but understood by the public as a Greens-negotiated deal, has fuelled the perception it is an extreme measure. It has helped Abbott turn an economically responsible, modest carbon scheme with public support into a hydra-headed monster.

No matter how effectively Greg Combet explains the scheme — and when he gets the chance he does it very well — the Greens factor is a barrier to popular acceptance.

Selling the carbon tax is hard. Selling the Greens is impossible.

-

09 July 2012, 090712, Carbon Tax, cost of living, goods or services, increase

Carbon Tax

Q. Since the carbon tax was introduced on 1st July, have you noticed any increase in the costs of goods or services?

Total

Vote Labor

Vote Lib/Nat

Vote Greens

Yes, have noticed an increase in costs 31%

23%

40%

17%

No, have not noticed any increase in costs 54%

69%

43%

77%

Don’t know 15%

8%

17%

6

31% say they have noticed an increase in the costs of goods or services since the carbon tax was introduced and 54% say they have not noticed any increase in costs.

Those most likely to say they have noticed an increase in costs were aged 25-44 (36%), Liberal/National voters (40%) and full-time workers (34%).